Medicare Part D Market Landscape Report Except: Coverage Gap Discount Program and the 2025 Manufacturer Discount Program

Qualia Bio recently released our 2023 Medicare Part D Market Landscape Report which provides readers with a comprehensive overview on the baseline knowledge required to accurately assess opportunities and threats related to biopharmaceutical brand access in Medicare Part D.

In today’s blog we discuss several excerpts from our Medicare Part D Landscape Report. Our topics include the current Medicare Part D Coverage Gap Discount Program (CGDP) and the Manufacturer Discount Program (MDP) which will replace the CGDP in 2025.

Coverage Gap Discount Program

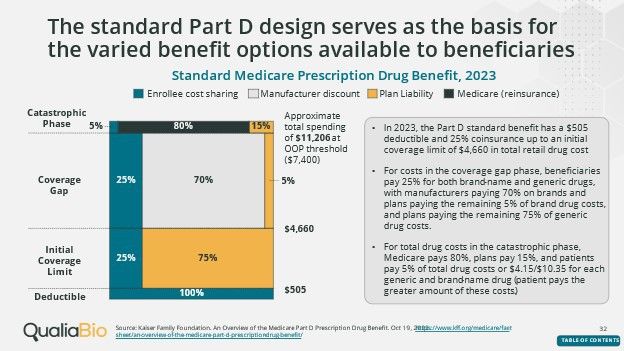

In Module 7 of the Part D Landscape Report, we review the CGDP. The program requires that biopharmaceutical manufacturers pay a statutory 70% discount for brand drug claims which fall into the coverage gap phase of the Part D benefit design. An overview of the standard Part D benefit design for 2023 is shown in Figure 1 below:

Figure 1

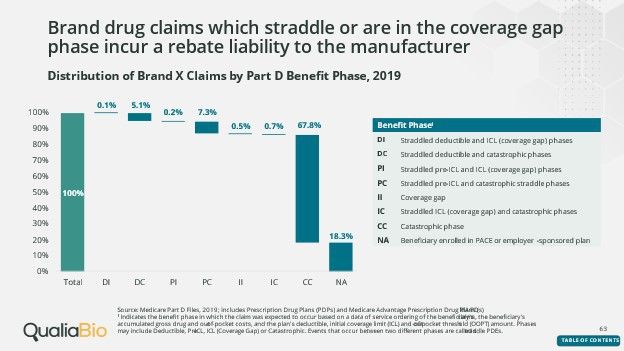

While it is commonly known that manufacturers incur a statutory discount liability for brand claims which fall into the coverage gap, a factor less understood is the impact of coverage gap “straddle claims.” A straddle claim occurs when a single formulary drug prescription claim crosses into different phases of the Part D benefit. In the case of a claim which straddles the coverage gap and other phases of the Part D benefit, a discount liability will also be realized from these claims in addition to those which fall completely within the coverage gap phase.

To illustrate this point, a coverage gap analysis conducted by Qualia Bio is seen in Figure 2 below. This analysis of Brand X evaluted total annual claims by benefit phase and revealed multiple cases of straddle claim utilization. One example of this is seen in the 7.3% of Brand X claims which occurred in the “PC” phase of the benefit (claims which straddle the pre coverage gap and catastrophic phases). These claims, and other Brand X straddle claims, result in a discount liability for the manufacturer.

Figure 2

Manufacturer Discount Program

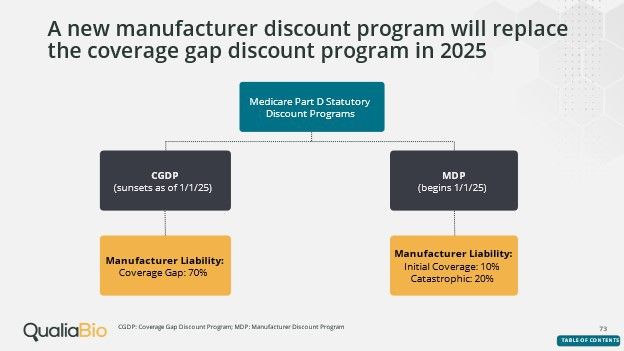

The CGDP will “sunset” in 2025 and be replaced by the MDP. While the coverage gap and its associated discounts will be eliminated, manufacturers will face new statutory discount liabilities as pictured in Figure 3:

Figure 3

In Module 8 of the Part D Landscape Report, we provide an overview of the key legislative changes to Part D based on the Inflation Reduction Act. One of the changes is the introduction of the MDP which introduces new levels of uncertainty related to manufacturer statutory discount liabilities in Part D. In the MDP, manufacturers will be responsible for a 10% discount on claims in the initial coverage phase (defined as patient out-of-pocket costs between approximately $506 - $1,199) and a 20% discount on claims in the catastrophic phase (patient out-of-pocket costs of $2,000 or more).

As with the CGDP, we can expect claims in the MDP to straddle different phases of the new Part D benefit. However, it is unknown at this time how CMS intends to account for straddle claims when assessing manufacturer statutory discount liability in the MDP.

Implications

For manufacturers developing new brands which are expected to have Part D utilization, it is important to understand potential CGDP and/or MDP Part D liabilities in order to accurately inform brand forecasts. Similarly, manufacturers with existing brands in the Part D market will have a need to assess how MDP liabilities might differ from those seen with the CGDP.

Contact Information

If you are interested in hearing more about our Part D Market Landscape report, please contact us to schedule a complimentary 30-minute webcast for you and your team.

Or, if you have questions as to how Qualia Bio can help with a custom CGDP or MDP statutory discount assessment, we can assist with those requests as well.

Please contact us via e-mail at: [email protected]