Medicare Part D Market Landscape Report excerpt: Cost share requirements and required utilization management criteria

Qualia Bio recently released our 2023 Medicare Part D Market Landscape Report which provides readers with a comprehensive overview and the baseline knowledge to accurately assess opportunities and threats related to biopharmaceutical brand access in Medicare Part D.

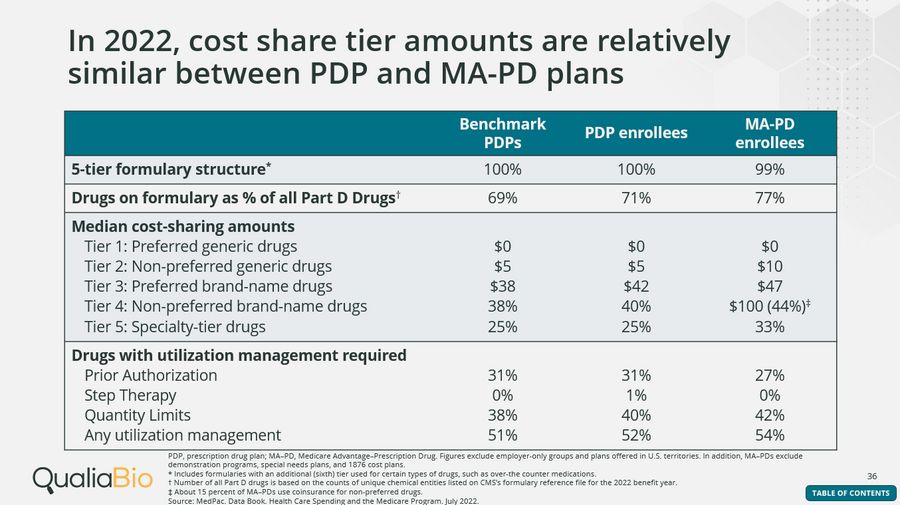

In today’s blog we discuss an excerpt from Module 3 of the report which is focused on Part D Benefit Design Dynamics. Our focus is on Medicare Part D cost share requirements and required utilization management criteria which are outlined in Figure 1 below:

Figure 1

Medicare Part D Formulary Tiering and Cost Share Requirements

In 2022, cost share tier amounts are relatively similar between PDP and MA-PD plans

Almost all Part D enrollees selected plans that have a five-tier formulary structure: two generic tiers (preferred and non-preferred), one preferred brand-name tier, one non-preferred drug tier, and a specialty tier.

For enrollees with a five-tier structure, median cost-share amounts in 2022 ranged between $0 to $10 for generic drugs and $38 to $47 for preferred brand-name drugs. Non-preferred brand name drugs use both coinsurance (ranging from 38% – 44%) and copays ($100 for 85% of MA-PDs). Specialty-tier drugs require statutory coinsurance levels between 25% to 33%.

For specialty tier drugs, CMS sets a maximum allowable cost share for a single specialty tier, or, in the case of a plan with two specialty tiers, the higher cost-sharing specialty tier. If the plan requires the standard deductible, coinsurance is 25%; if the beneficiary is enrolled in a plan where no deductible is required, coinsurance is 33%. For plans with some level of decreased deductible, coinsurance may range between 25 -33%.

Medicare Part D Utilization Management

2022 benchmark PDP, PDP and MA-PD enrollees had access to 69%, 71%, and 77% of all covered Part D drugs, respectively. The number of drugs listed on a plan’s formulary, a list of prescription drugs covered by a specific health insurance plan, affects a patient’s access to affordable medications.

In addition to the number of drugs listed on a plan’s formulary, prior authorization (preapproval for coverage), quantity limits (the number of doses a drug can be given in a period of time), step therapy requirements (drugs required to be tried before being prescribed a specific drug), and other types of utilization management, can affect a patient’s access to certain drugs.

Average use of any type of utilization management was 51% for benchmark PDPs, 52% for PDPs, and 54% for MA-PDs in 2022.

Prior authorization was required for 27% and 31% of PDP and MA-PD plans.

Quantity limits applied to 40% and 42% of drugs listed on stand-alone PDP and MA–PD formularies, respectively.

Overall use of step therapy was very low with only 1% of PDP drugs requiring it.

Implications

In a 5-tier design, Tier 4 generally has coinsurance requirements which are higher than Tier 5 due to CMS statutory limits on the specialty tier – thus, brands which receive coverage in the non-preferred brand tier are generally at a cost-share disadvantage when contrasted with drugs in the specialty tier. Differential specialty tier options are also available and may increase competition for preferred tier placement among specialty drugs.

In 2022, half of listed Part D drugs are subject to some form of utilization management. For brands in non-protected classes, plan sponsors have wide latitude to exclude or implement restrictive utilization management criteria in most therapeutic categories.

Contact Information

If you are interested in hearing more about our Part D Market Landscape report, please contact us to schedule a complimentary 30-minute webcast for you and your team. Or, if you have business questions which require custom Part D analytics, we can assist with those requests as well. We can be reached via e-mail at: [email protected].