MedPAC’s June report

Calls for 2% bump to hospital payments, no update for docs in 2022, and standardized payments across ambulatory care settings

As part of its mandate from the Congress, each June MedPAC reports on Medicare payment systems and issues affecting the Medicare program. The 267-page report contains recommendations on varying topics, including alternative payment models, access to care, and payments to Medicare Advantage plans. Here, we highlight some points in the June 2022 that are key to the biotech industries developing therapies that may be impacted by Medicare coverage and reimbursement.

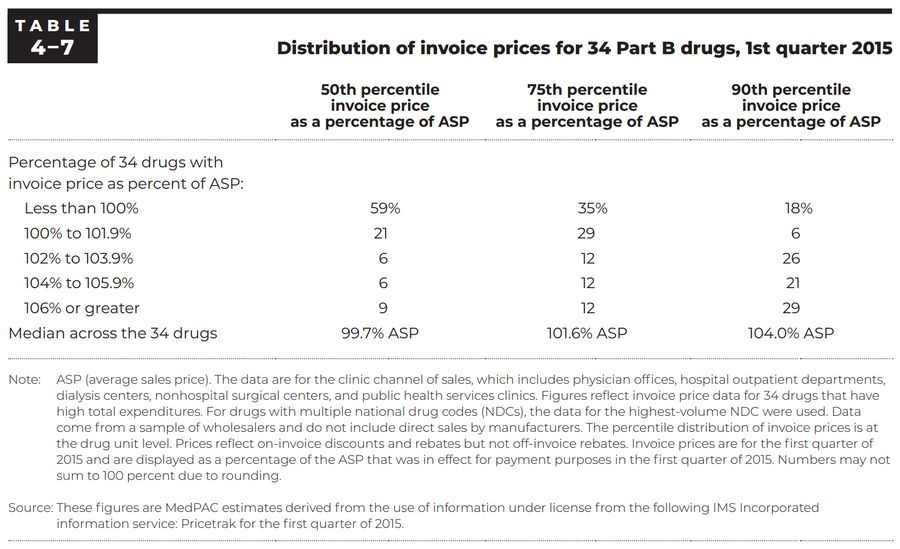

Invoice prices for 34 Part B drugs. Check out our ASP/WAC comparison tool for more insights into pricing.

Aligning fee-for-service payment rates across ambulatory settings. The Commission presents an analysis of an approach to align the payment rates across ambulatory settings—hospital outpatient departments (HOPDs), ambulatory surgical centers (ASCs), and freestanding physician offices—that currently have different Medicare payment rates for the same services.

Addressing high prices of drugs covered under Medicare Part B. The Commission discusses approaches for Medicare Part B to address high launch prices for new “first-in-class” drugs with limited clinical evidence, high and growing prices among products with therapeutic alternatives, and financial incentives associated with the percentage add-on to Medicare Part B’s payment rate.

Segmentation in the stand-alone Part D plan market. The Commission discusses segmentation in the market for stand-alone prescription drug plans (PDPs) based on beneficiaries’ eligibility for Part D’s low-income subsidy (LIS) and drug spending, its effects on Medicare spending, and potential policies to address segmentation and its effects.

Part B Invoice Prices

MedPAC reported on the Commission’s June 2016 report to the Congress, in which the Commission analyzed proprietary IMS Health data on invoice prices for a group of high-expenditure Part B drugs to get a sense of how providers’ acquisition costs for drugs compared with ASP (Medicare Payment Advisory Commission 2016). The table below summarizes some of the findings.

Aligning fee-for-service payment rates across ambulatory settings

Medicare payments differ across ambulatory settings—HOPDs, ASCs, and freestanding physician offices. These varying methods may encourage arrangements among providers that result in care being provided in the settings with the highest payment rates (generally, the HOPD setting). Of the OPPS’s 169 APCs for services, MedPAC identified 57 APCs for which it would be reasonable and appropriate to align the OPPS and ASC payment rates with those set in the physician fee schedule (PFS).

Addressing high prices of drugs covered under Medicare Part B

Medicare spending on prescription drugs covered under Part B was about $40.7 billion in 2020. MedPAC reports concern over high and growing launch prices and proposes approaches to improve price competition and payment for Part B drugs by the Medicare program:

Use coverage with evidence development (CED) to collect clinical evidence relevant to Medicare beneficiaries about the new drug while providing patients access to the product

Set a cap on the drug’s payment rate based on information about the new product’s estimated net clinical benefit (based on evidence from, for example, FDA clinical trials) and cost compared with the standard of care, to prevent manufacturers from setting a high price for a new product with little or no evidence that it is more effective than existing standards of care. Medicare would need to develop a clear and predictable decision-making framework that ensures transparency and opportunities for public input, including how comparator treatments would be selected, how costs would be defined, and what time horizon would be used.

Use internal reference pricing, under which Part B drugs would remain in their own billing code but Medicare would establish a single reference price for those with similar health effects.

Modify the payment add-on (currently, ASP + 6%) by placing a fixed dollar limit on the add-on payment, converting a portion of the percentage add-on to a fixed fee, or a combination of these approaches.

Segmentation in the stand-alone Part D plan market

The Part D program uses stand-alone PDPs to provide drug coverage to beneficiaries in the FFS Medicare program. Insurers that participate in the PDP market can offer up to three plans, and they tailor those plans to appeal to different types of beneficiaries. Most major insurers generally offer one plan to target LIS beneficiaries and two plans to target beneficiaries without the LIS—one for those with low drug costs and one for those with high drug costs. Insurers differentiate their plans through a mix of program rules and changes in plan features such as premiums, beneficiary cost sharing, the specific drugs covered by the plan, and pharmacy networks. Two distinctive features of this strategy are keeping the premium for the plan that targets LIS beneficiaries just below the LIS subsidy amount and offering plans with “enhanced” coverage (which combines standard Part D coverage with supplemental benefits) that turn out to have lower premiums than plans with “basic” coverage (which is limited to standard coverage only).

Segmentation may make it harder for beneficiaries to understand their plan options, despite requirements that insurers offer plans with meaningful differences. The common-sense distinction between “basic” and “enhanced” plans has been lost, and it can be difficult to determine what extra benefits are provided by enhanced PDPs with low premiums. MedPAC suggests:

Modifying the auto-enrollment process for LIS beneficiaries. Policymakers could give insurers a stronger incentive to bid more competitively by auto-enrolling a larger share of new LIS beneficiaries in plans with lower premiums and reassigning LIS beneficiaries to new plans when premiums rise above the benchmark.

Changing how the requirement for plans to have “meaningful differences” is administered. For example, policymakers could require enhanced PDPs to cover a minimum percentage of the out-of-pocket costs that their enrollees would otherwise pay for basic coverage. This approach would prevent insurers from offering enhanced PDPs with very little additional coverage.

Requiring PDP insurers to treat their enrollees as a single risk pool for the purpose of providing basic coverage. Under this reform, every enrollee in an insurer’s PDPs would pay the same premium for basic coverage and have the same formulary, costsharing rules, and pharmacy network. Insurers would still be allowed to offer enhanced coverage, but only by providing extra benefits on top of the uniform basic coverage, somewhat akin to an insurance rider. As under the current system, enrollees would pay for the full cost of any extra benefits through a supplemental premium.