Prescription drug price reform: Which drugs are potentially eligible for price negotiation?

On August 16th, President Biden signed into law new prescription drug price reform as part of the broader Inflation Reduction Act of 2022. As part of the new law, Medicare will be allowed to negotiate the price of select high-expenditure prescription drugs with biopharmaceutical manufacturers.

Identification of “negotiation-eligible drugs” will occur through an initial review of the top 50 Medicare Part D and Part B drugs based on total Medicare expenditures for each drug. From this initial list, the top single-source brand name drugs by total Medicare expenditures would be targeted for government negotiations on a “maximum fair price” in the years that follow:

2026: top 10 Part D drugs

2027: top 15 Part D drugs

2028: top 15 Part D and Part B drugs

2029 & later years: top 20 Part D and Part B drugs

The number of drugs selected for Medicare price negotiation is expected be cumulative (e.g., 10 drugs in 2026, 25 drugs in 2027, 40 drugs in 2028, and 60 drugs in 2029 and beyond). Qualia Bio’s current interpretation is that the combined list of top 50 Part D and Part B drugs (100 target drugs in total) would be the basis for the selection of negotiation-eligible drugs. While not specifically called out in the legislative language, our working assumption is that the top 100 list will be ranked by total expenditures for Part D and B beginning in 2028 – the top 40 from this combined list would be selected in 2028 and the top 60 selected in 2029 and beyond. This assumption will be further evaluated for accuracy as additional legislative details becomes available.

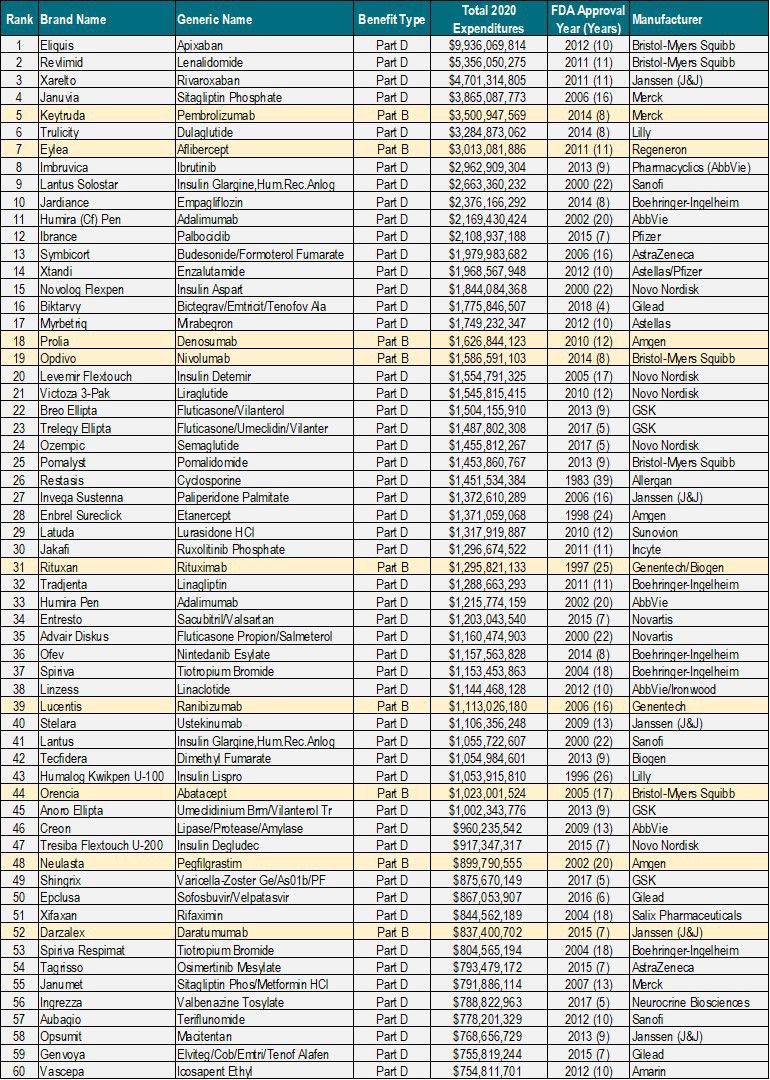

To provide an illustrative example as to which types of drugs may initially qualify for being “negotiation-eligible,” Qualia Bio reviewed the top 60 drugs in Part D and B by total Medicare expenditures in 2020 (see Table 1). While this list does not reflect the actual Medicare calendar year data that will be used to identify negotiation-eligible drugs for 2026 and beyond, it does provide a sense of the volume and related total Medicare expenditures which could make a brand a potential candidate for Medicare drug price negotiation.

Table 1. Top 60 Part B and Part D Drugs by Total Medicare Expenditures in 2020

Source: CMS Part B & Part D Dashboards

Differential time on market thresholds (e.g., years after FDA approval) are highlighted as one of the factors by which negotiation-eligible drugs are identified. New drugs will not be subject to negotiation until they have been on the market for 7 years (small molecules) or 11 years (biologics) respectively.

The initial list of negotiation-eligible drugs will be published and negotiations are tentatively planned in the time period of approximately 2 – 2.5 years prior to the 2026 program start date.

Exceptions to price negotiations exist for small biotech companies defined as those with drugs ≤ 1% of total Part D or B expenditures for all covered drugs and accounting for 80% of total expenditures under Part D or B for all covered drugs in 2021 for that particular manufacturer. These exclusions are specific to the time period of 2026 – 2028.

An orphan drug exclusion from price negotiation is available for drugs with only one rare disease or indication for which it is the only approved indication for that disease or condition.

Finally, new formulations (term is not defined but expressly includes extended-release formulations) and plasma-derived products also receive an exclusion from being subject to price negotiation.

A “special rule” to delay selection and negotiation of biologics for biosimilar market entry is also included in the proposed legislation. This provision aims to encourage biosimilar competition by stipulating that the selection of a biologic for price negotiation could be delayed for up to two years if there is a “high likelihood” of biosimilar competition before a negotiated price would take effect. To prevent gaming, the bill would impose rebates on biosimilars that are approved, but not launched within the delay period.

Implications

A recent government analysis estimates that allowing Medicare to negotiate drug prices in limited circumstances would bring about $80 billion in savings.1

While this legislation will have a direct impact on the manufacturers with prescription drugs selected for price negotiations, only non-biologic drugs that have been on the market for 7 years, or biologics for 11 years, can be considered for price negotiation. Thus, the best-selling drugs in a manufacturers portfolio will have a reduced capacity to generate financial returns on investment over the latter years of the brands lifecycle.

For manufacturers that are not selected or eligible for price negotiations, there may be an indirect impact for brand name drugs that compete in therapeutic categories with competitors who have been selected. For example, commercial payers could leverage Medicare pricing for a market leading brand to drive down net cost, thus impacting an entire therapeutic category.

References

Contact Information

Contact Qualia Bio to schedule a complimentary 30-minute webcast for you and your team in which we review the key components of the new law and identify the associated market access risk factors. We can be reached via e-mail at: [email protected]