The Inflation Reduction Act – How Will Negotiated Prices Impact the Medicare Part D Market?

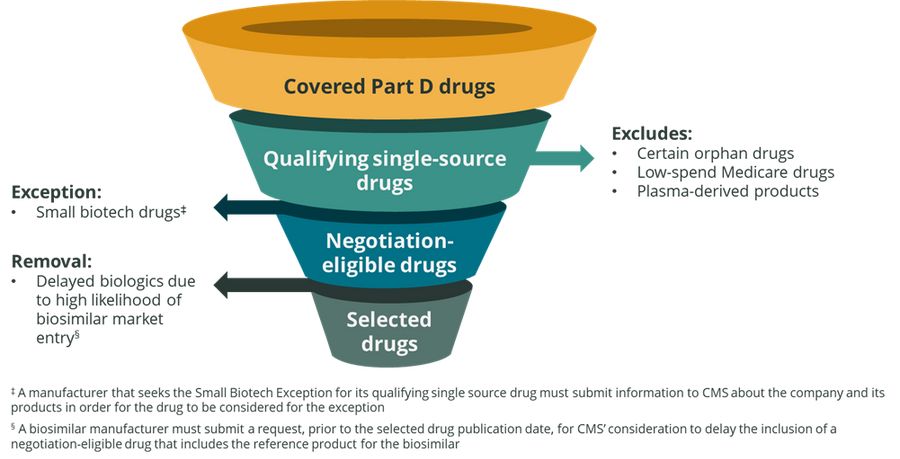

The Department of Health and Human Services Centers for Medicare and Medicaid Services (CMS) recently released initial guidance on Inflation Reduction Act (IRA) implementation of the Medicare Drug Price Negotiation Program for initial price applicability year 2026. For the initial price applicability year of 2026, 10 Medicare Part D drugs will be selected for negotiation on a Maximum Fair Price (MFP). Select exceptions, exclusions, and removals will be used to evaluate Part D drugs as seen in Figure 1 below. From this process, CMS will identify 50 qualifying single source drugs that have the highest total expenditures to be considered for price negotiations. The 10 Part D drugs selected for price negotiation in 2026 will be drawn from this list.

Figure 1: CMS Medicare Part D Drug Selection Process for Initial Price Applicability Year 2026

Part D Price Negotiation is a Therapeutic Class Dynamic

The key implication of price negotiation for biopharmaceutical manufacturers to understand is that price negotiation must be considered on a therapeutic class level, not an individual drug basis. Any drugs included in the same therapeutic class as an MFP drug will be subject to competitive pressures stemming from the pricing of the MFP brand. Plan sponsors manage utilization to drug trend, a combination of price, utilization, and sometimes other factors such as brand/generic mix. Assuming that drug trend in MFP therapeutic classes is likely to be characterized by lower net cost (due to the MFP drug) and higher utilization (due to the $2,000 cap on patient out-of-pocket costs in the Part D benefit redesign which is expected to result in increased prescription volume), we can make informed assumptions as to how plan sponsors will approach the management of MFP therapeutic classes.

Based on the expected MFP class drug trend dynamics, Part D plan sponsors could respond with increased utilization management (UM) and formulary access restrictions which may include the following:

Step Therapy Criteria: payers could elect to implement step-edits which require previous trial and failure of the MFP drug prior to approving therapeutic alternative brands. This would serve to limit the volume of prescriptions which might flow to therapeutic alternatives to the MFP brand

Formulary Exclusion: Part D plan sponsors will be required to cover the MFP drug. To limit utilization of higher cost alternative drugs, they may consider narrowing a non-protected therapeutic class while keeping within existing CMS requirements (2 drug minimum for non-protected class) by excluding one or more therapeutic alternatives

One way manufacturers can think about competition in a therapeutic class which includes an MFP drug is to consider it as being somewhat similar to the UM and formulary changes which occur when a market-leading brand loses patent exclusivity. As a broad rule of thumb, generics often result in an 80 – 85% drop in list price from the reference brand. The Congressional Budget Office estimates that net prices for negotiation-selected drugs will decrease by 50% on average as a result of negotiation. For drugs on the market for 16 years or more, the minimum discount required for the MFP is 60%.

Thus, some MFP drugs may end paying discounts which bring their net cost closer to that of what one would expect for a generic as opposed to a discounted brand product. While it is unclear as to how plan sponsors will respond at this point, manufacturers should consider potential scenarios such as an MFP drug being placed in a generic tier in addition to the step therapy and exclusion dynamics mentioned previously. Potential brands and therapeutic classes which may be at risk of future minimum MFP discounts of 60% include the following:

Januvia, Janumet (diabetes)

Enbrel (autoimmune)

Symbicort, Spiriva (asthma, COPD)

Invega Sustenna (atypical antipsychotics)

Xifaxan (IBS-D)

Thus, the net effect of an MFP entry to a Part D therapeutic class is to "speed up the clock" on revenue erosion for mature brands. This may impact a firm in two ways:

Direct impact scenario: a company's mature brand is selected for price negotiation and is subject to an MFP. This will result in generic-like erosion to net revenue prior to the expected LOE date. Impacted firms should reassess late-stage brand lifecycle plans and be active in business development and pipeline management to offset the expected loss

Indirect impact scenario: firms who do not have an MFP drug but are competing in a therapeutic class with an MFP alternative will have to plan for generic-like competition described above. This suggests the need for development of alternative brand access scenarios to assess impact and revise forecasts if needed

These dynamics may be particularly acute in the case of specialty drugs. When the Part D benefit redesign is finalized in 2025, plan sponsors will be at risk for 60% of drug costs in the catastrophic phase above $2,000. This contrasts sharply with current risk levels of 15% in the catastrophic phase. Qualia Bio expects plan sponsors to markedly increase UM in order to manage the significant increase in risk they will face in the catastrophic phase of the revised Part D benefit design.

MFP Drugs are Market Leaders

By definition, drugs selected for price negotiation will be market leaders as CMS intends to select those drugs with the highest total expenditures in Part D. Thus, market leading drugs are likely to be able to incrementally build on their existing demand advantage if they are selected for price negotiation due to the universal access they will have in Part D. Based on this dynamic, manufacturers should consider the following questions as part of their business planning process if their drug is in an MFP therapeutic class:

How might plan sponsors leverage the MFP drug to increase rebates on therapeutic class alternatives due to demand dynamics favoring the MFP brand?

Assuming increased Part D plan sponsor pressure on net prices, how will our Part D contracting strategy need to evolve to meet this challenge?

Do we need to adjust brand gross-to-net and market share projections if our drug ends up in an MFP therapeutic class?

Are any of our pipeline agents in therapeutic classes which might include an MFP brand in the future? If so, what are the implications of this in terms of projected demand for the investigational compound?

Clinical distinctions between MFP therapeutic class alternatives will undoubtedly play an important role in determining the business impact on a given brand. Differing levels of brand drug clinical differentiation relative to an MFP brand could result in Part D access strategies which vary from preservation of existing volume to blunted growth arising from the difficulties of competing against a market leading brand with a decided net price advantage.

Summary

In addition to price negotiation, a number of additional changes to the Part D market will be coming courtesy of the Inflation Reduction Act (IRA) which includes benefit redesign and prescription drug inflation rebates. Manufacturers will need a detailed understanding of the underlying Part D market dynamics to navigate the uncertain future which awaits all Part D drugs. Qualia Bio can help manufacturers plan and prepare for this future market with our Medicare Analytics platform which can address a wide variety of business planning needs.

Questions or inquiries on the IRA or other Medicare business questions? Please contact us at [email protected].