Medicare Part D LIS Overview

Medicare Part D paid for outpatient prescription drug coverage on behalf of 49 million Medicare beneficiaries in 2021. Part D also includes a low-income subsidy (LIS) that helped with premiums and cost-sharing for approximately 13 million individuals with low income and assets in 2021.

Medicare Part D LIS Overview

Medicare Part D paid for outpatient prescription drug coverage on behalf of 49 million Medicare beneficiaries in 2021. Part D also includes a low-income subsidy (LIS) that helped with premiums and cost-sharing for approximately 13 million individuals with low income and assets in 2021.

In order to optimize the subsidy, LIS members must enroll in Part D prescription drug plans (PDP’s) which are at or below the regional benchmark which is based on monthly premium amounts. LIS enrollees who have not selected a plan themselves are automatically enrolled in a benchmark PDP to which CMS assigns them randomly. Medicare Advantage Prescription Drug (MA-PD) programs cannot receive auto-enrollees, yet LIS enrollment was roughly split between PDP (47%) and MA-PD (53%) plans in 2021. As with non-LIS beneficiaries, LIS beneficiaries are highly concentrated at a limited number of plans. In 2020, 90% of LIS beneficiaries were in plans offered by five sponsors: CVS Health, UnitedHealth Group, Humana, WellCare, and Cigna.

Most LIS enrollees pay nominal co-payments throughout the Part D benefit; Part D’s LIS pays for the remainder of plans cost-sharing requirements on their behalf. In 2022, most individuals receiving the LIS pay between $0 - $9.85 for a brand and $0 - $3.95 for a generic drug prescription. For non-formulary brand drugs approved through an exception process, LIS beneficiaries would be subject to the same $9.85 cost share. Once LIS members are above the Part D out-of-pocket threshold they pay no cost share at all and these claims do not result in a coverage gap discount liability for the manufacturer.

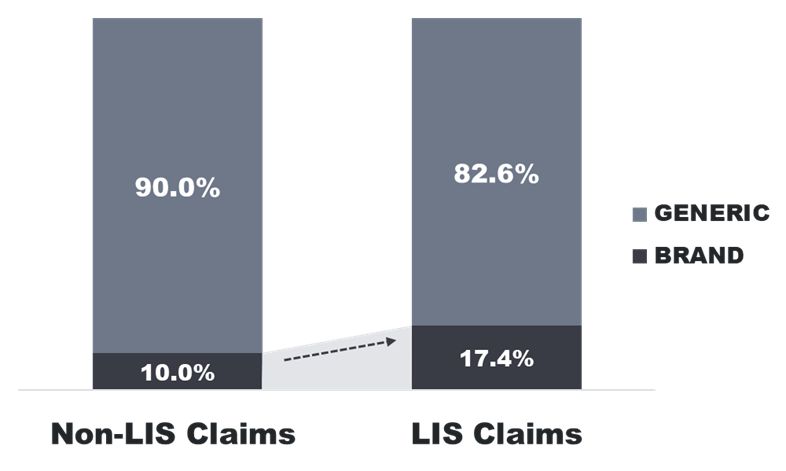

While the LIS helps to ensure access to medicines for low-income beneficiaries, its subsidized cost sharing gives limited incentives to use lower cost drugs. This is in part due to the limited dollar differential between brand and generic cost share in addition to the fact that LIS beneficiaries pay no more than $9.85 for a preferred or non-preferred brand drug (including specialty drugs). In a recent analysis conducted by Qualia Bio, we found that LIS beneficiaries had a higher percentage of brand drug claims when contrasted with that of the non-subsidy population based on a review of 2020 Part D claims seen in Figure 1 below.

Figure 1. 2020 Part D Brand / Generic Claim Utilization by Subsidy Status

LIS: Low Income Subsidy. Part D Low-income subsidy (LIS) beneficiaries includes beneficiaries with full or partial subsidies. Source: Medicare Part D File, 2020, accessed via a research-focused data use agreement with CMS.

Thus, the LIS population has responded to incentives inherent to the subsidy design by using a disproportionately higher percentage of branded products when compared to the non-subsidy population. In performing LIS analysis for specific Part D brand drugs, Qualia Bio has found a similar pattern in that LIS claims account for a surprisingly high percentage of overall utilization across many Part D brands.

Implications

For biopharmaceutical manufacturers of brand drugs subject to Part D coverage, the LIS sub-population represents an important market segment to understand. Characteristics unique to this population include limited OOP cost share sensitivity, an affinity for brand drug use, and the concentration of LIS PDP beneficiaries among a relatively small number of plans.

These characteristics have important implications for biopharmaceutical brand access. A one size fits all Part D access strategy that does not account for LIS sub-population distinctions may lead to missed opportunities in improving brand access.

Contact us at for more information as to how our LIS and Medicare / Medicaid analytics can help you develop more efficient and effective brand access strategies for the Part D market. We can be reached at [email protected]