Medicare Cost Report

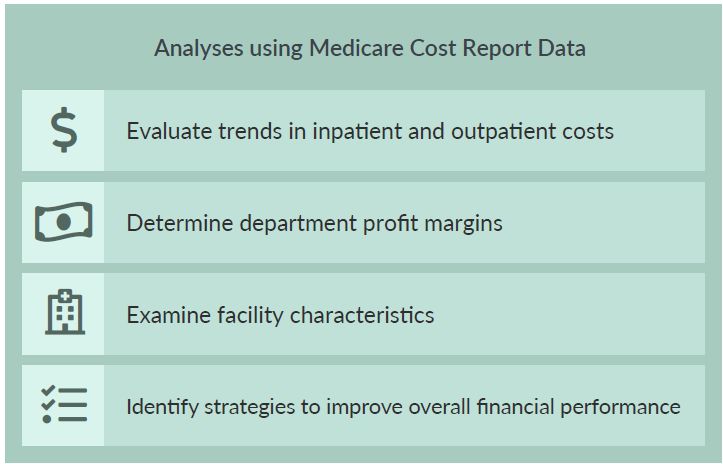

What Are Medicare Cost Reports?….Medicare Cost Reports are also used by providers, financial analysts, and researchers to understand trends in inpatient and outpatient costs, determine department profit margins, examine facility characteristics, and identify strategies to improve overall financial performance. …

What Are Medicare Cost Reports?

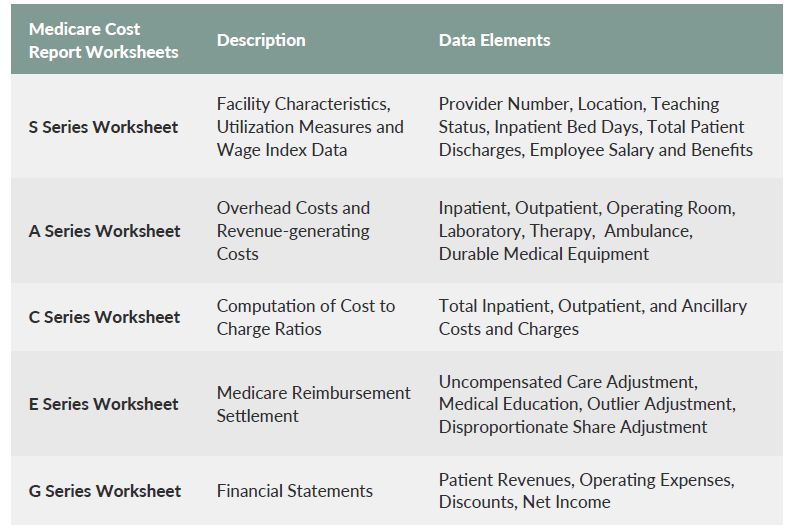

The Centers for Medicare and Medicaid Services (CMS) requires Medicare-certified institutional providers to submit annual cost reports to Medicare.1 Medicare Cost Reports are a primary source for provider financial and statistical data. The report contains a series of worksheets with informa7on on facility characteris7cs, health care utilization, employee salary and wage data, facility costs and charges, and Medicare settlement data. CMS maintains the report data in the Healthcare Provider Cost Reporting Information System (HCRIS).[1] Cost reports are available for all reporting periods since 1996 and are the only national data available for all types of providers (government, non-profit, for-profit).2

Example of Hospital Medicare Cost Report Worksheets

Purpose of Medicare Cost Reports

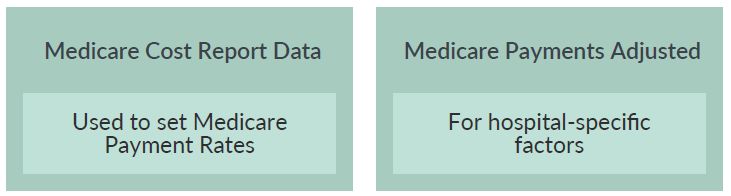

Medicare Cost Report is a key resource used by CMS to determine Medicare payments and adjust reimbursement amounts to account for hospital-specific factors.3 CMS derives financial and statistical data reported in the cost reports to set Medicare payment rates and calculate adjusted reimbursements for provider spending on medical education (both direct and indirect programs), uncompensated care, low-income patients, and high-cost Medicare cases.4,5 Additionally, to maintain standardized Medicare payments across facilities in different geographic areas, CMS derives the wage index from wage data reported in the cost reports. The wage index accounts for variation in the cost of labor in different parts of the country; Medicare payments are adjusted upward for areas with higher wage index values, and downward for areas with lower wage index values.6,8

Medicare Cost Reports are also used by providers, financial analysts, and researchers to understand trends in inpatient and outpatient costs, determine department profit margins, examine facility characteristics, and identify strategies to improve overall financial performance.2

Medicare Cost Reports Influence Future Provider Profitability

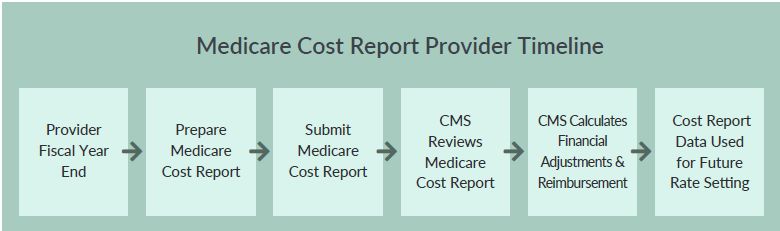

Medicare Cost Reports have a significant impact on future Medicare payment policies and provider profitability. Providers are required to submit annual cost reports five months after the end of their fiscal year. Medicare calculates future reimbursement and payment rates based on cost data submitted annually, which has an impact on facility revenue and financial performance for the following year. It is critical for providers to submit accurate and timely financial data, particularly for providers who depend on Medicare for most of their revenue.

What Facilities Submit Cost Reports?

The types of facilities required to submit annual cost reports include hospitals, skilled nursing facilities, home health care agencies, hospices, rural health clinics, Federally Qualified Health Centers (FQHCs), and End Stage Renal Disease (ESRD) facilities – all facilities that provide care to Medicare patients and participate in the Medicare program. Facilities excluded from this requirement are Federal Hospitals (Veterans Hospitals, Indian Health Services Hospitals), emergency hospitals, and some children’s hospitals.1,2

References

Centers for Medicare and Medicaid Services. Cost Reports. 2020 [Accessed May 31, 2020]; Available from: https://www.cms.gov/Research-StaHsHcs-Data-and-Systems/Downloadable-Public-Use-Files/Cost-Reports/.

Research Data Assistance Center (ResDAC). Introduction to Medicare Cost Reports. 2013 [Accessed May 31, 2020]; Available from: https://www.resdac.org/sites/resdac.umn.edu/files/Introduction%20to%20Medicare%20Cost%20Reports%20(Slides).pdf.

Juliette Cubanski, C.S., Cristina Boccuti, Gretchen Jacobson, Giselle Casillas, Shannon Griffin, and Tricia Neuman. A Primer on Medicare: Key Facts About the Medicare Program and the People it Cover. 2015 [Accessed May 31, 2020]; Available from: https://www.kff.org/report-secHon/a-primer-on-medicare-how-does-medicare-pay-providers-intradiHonal-medicare/.

TransUnion Healthcare. Getting the Medicare Cost Report Right the First Time. 2018 [Accessed May 31, 2020]; Available from: https://revcycleintelligence.com/news/getting-the-medicare-cost-report-right-the-first-time.

Centers for Medicare and Medicaid Services. Prospective Payment Systems - General Information. 2019 [Accessed May 31, 2020]; Available from: https://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/ProspMedicareFeeSvcPmtGen.

Dalton, K., R.T. Slifkin, and H.A. Howard, Rural hospital wages and the area wage index. Health care financing review,2002. 24(1): p. 155-175.

G. Mark Holmes, P., Kristie W. Thompson, MA and George H. Pink, PhD. A Rural Urban Comparison of the Proposed 2020 Wage Index 2019 [Accessed May 17, 2020]; Available from: https://www.shepscenter.unc.edu/wp-content/uploads/dlm_uploads/2019/06/Wage-Index-QuarHle-Proposal.pdf.

George H. Pink, P.K.W.T., MA; H. Ann Howard, BS 2019 Wage Index Differences and Selected Characteristics of Rural and Urban Hospitals. 2019 [Accessed May 19, 2020]; Available from: https://www.shepscenter.unc.edu/wpcontent/uploads/dlm_uploads/2019/04/Wage-Index-Finance.pdf.